Not sure whether to buy a house or an apartment for your first home? You’re not alone.

For many first-home buyers in Australia, the biggest decision isn’t just where to buy, it’s what to buy. Should you go for a freestanding house with a backyard, or a unit that’s easier to maintain? Add the choice between new builds and established properties, and it’s easy to feel overwhelmed.

Here’s the good news: there’s no one “right” answer; only the right fit for you. Let’s break it down.

House vs Apartment: What’s the Difference?

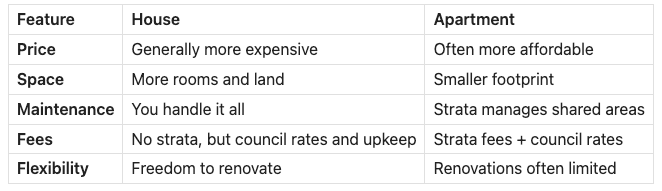

Houses give you space, land and freedom, but they often come with a higher price tag and more maintenance.

Apartments (units) are usually more affordable and lower maintenance, often located in lifestyle-friendly areas, but may mean less space and extra fees (like strata).

Buying New vs Established

- New builds can offer lower maintenance and, in some cases, access to certain government grants depending on eligibility and local criteria

- Established homes often have an existing track record in the local market, though their condition and value still need careful assessment. A building and pest inspection is generally recommended to help identify potential issues

So… What’s Right for You?

Ask yourself:

- Do I want space for a pet or future kids?

- How much time (and budget) can I put into maintenance?

- Do I care more about lifestyle (cafés, transport) or land?

- What can I realistically afford when I factor in fees, rates, and insurance?

If you’re feeling unsure, that’s okay, this is one of the biggest decisions you’ll make. But you don’t have to make it alone.

Ready to Figure Out What FitsYou?

Choosing between a house and an apartment is deeply personal, and the best choice depends on your goals, lifestyle, and finances. That’s why we created the First Home Buyer e-book; a free, friendly guide packed with checklists, calculators, and expert tips to help you weigh your options and plan with confidence.

Download the free e-book now and help you feel more informed and confident as you work through your first-home decision. It may be a helpful resource as you navigate your options